A Carfax Total Loss occurs when the cost of repairing a car exceeds a certain percentage of its value. When an insurance or fleet company assesses that a vehicle has sustained damages surpassing approximately 75% of its value prior to the occurrence of the damages, or if the vehicle is stolen and remains unrecovered, it is designated as a total loss. The insurance company declares the car as “totaled” and provides a payout to the owner of the current estimated value of a similar car in fair or excellent condition. A car declared a Total Loss will get a salvage title which remains on the registration records even if the car has been repaired and road worthy.

Carfax Online VIN Checker:

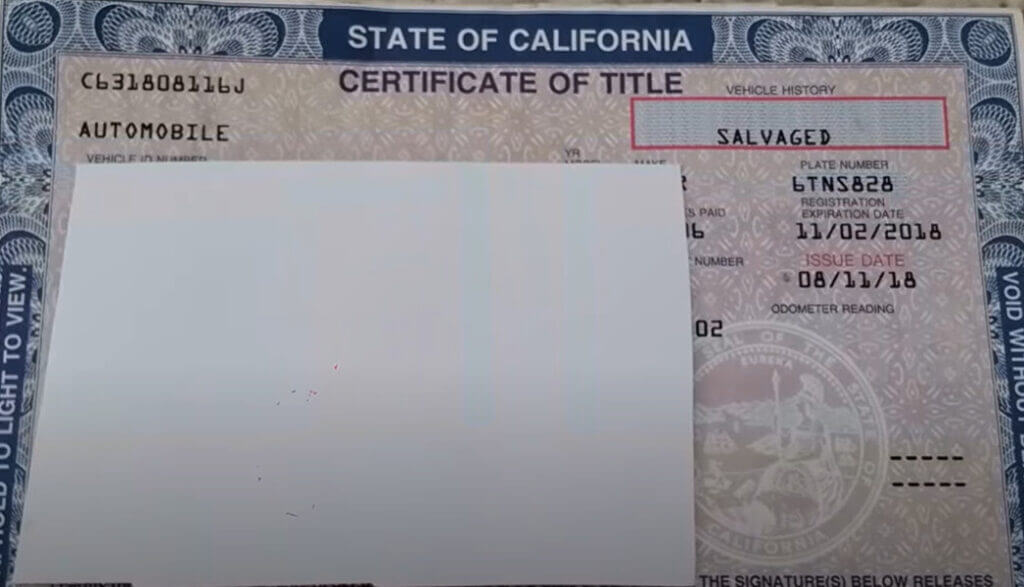

How to tell if a car has a salvage title?

To tell if a vehicle has a salvage title, begin by looking at the branding found on the top right corner of the latest ownership title. On the ownership title deed, there is a box in the top right corner that mentions Vehicle History. If this vehicle history box is empty it means it has a clean title, otherwise, the box will indicate either Salvaged, Lemon Buy Back, or other similar warnings.

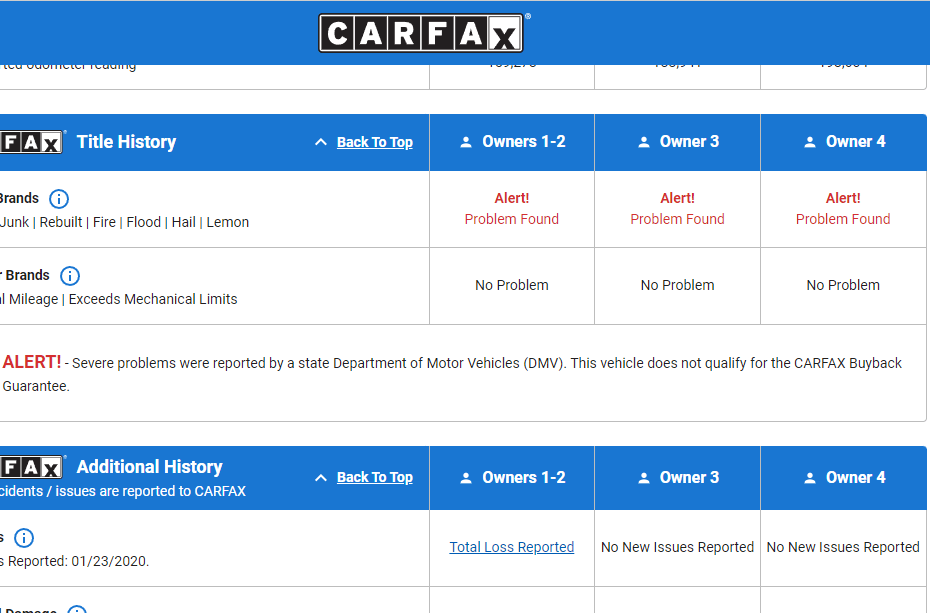

What is a SALVAGE TITLE IN CARFAX REPORT?

A salvage title on a Carfax report indicates that a vehicle has been severely damaged and was deemed a total loss by an insurance company. This usually happens when the cost of repairing the vehicle exceeds a certain percentage of its value, often around 75%. Vehicles with salvage titles have often been in major accidents, floods, or fires.

It’s important to note that a salvage title significantly affects a vehicle’s value and safety. Even if the vehicle has been repaired, it may have hidden structural or mechanical problems. Additionally, these vehicles can be more challenging to insure and finance. Buyers should exercise caution and consider a thorough inspection by a qualified mechanic before purchasing a vehicle with a salvage title.

If you do not have access to the vehicle Title, you can purchase a vehicle history report, which provides comprehensive details about the vehicle, including any instances where it was deemed a salvage title vehicle. This report will contain the vehicle identification number (VIN), which is crucial for tracking the vehicle’s history. Investigate any vehicle claim associated with the car, particularly focusing on flood damage or water damage, as these are common reasons for a vehicle to be labeled with a salvage certificate. Consider the financial aspects such as whether the car was once collateral for a personal loan or if its value has depreciated to that of scrap metal. Salvage title cars, including cars with salvage titles, are governed by salvage title law, which varies by jurisdiction but generally involves thresholds for repair costs. A potential buyer of a salvage title car would consult a database of vehicles to compare the subject vehicle against known flood vehicles or those used in law enforcement, as these have higher chances of having sustained significant collision damage or minimal damage that still merits salvage branding. The concept of Salvage brands indicates a vehicle’s history of significant damage. Despite this, some find purchasing these vehicles a fantastic deal, due to their lower cost. Review the disclosure statement for any salvage vehicle to understand the extent of damage and repairs. This aids in evaluating whether there’s legal recourse should the vehicle not meet the standards or representations made. Consider the fair market value of the vehicle. An Affidavit of Salvage Vehicle may be required in some jurisdictions to ascertain the fair market vehicle value post-repair, ensuring the vehicle owner is aware of the car’s true value and history. This comprehensive approach allows buyer of a salvage title car to ascertain the status of a vehicle accurately, particularly when considering salvage-titled vehicles.

What Constitutes an Insurance Total Loss?

When an insurance or fleet company assesses a vehicle’s damages and determines that they exceed approximately 75% of its pre-damage value, or if the vehicle has been stolen and remains unrecovered, it is declared a total loss. It’s important to note that the specific threshold for defining total loss may vary among different insurance companies. However, not all total loss vehicles automatically result in a DMV-reported branded title, such as Salvage or Junk.

What is a Carfax Total Loss?

When a CARFAX Total Loss vehicle is mentioned, it refers to a car that has been declared a total loss by an insurance company due to severe damage, such as from an accident or natural disaster. In such cases, the cost of repairing the car exceeds its actual cash value. As a result, the insurance payout is made based on the car’s pre-accident worth. It’s important to note that a CARFAX Total Loss vehicle may have a salvage title, which indicates that the car has undergone significant damage and has been deemed a total loss by an insurance company. The salvage title can affect the resale value and insurability of the vehicle in the future.

CARFAX does not conduct inspections on the vehicles they provide reports for. It is important to acknowledge that a CARFAX report has the potential to undergo modifications subsequent to the date of purchase. In order to ensure a state of tranquility, it is advisable to have the vehicle undergo an inspection conducted by an impartial third party

Clean Title on an Insurance Total Loss Vehicle

It is possible that a car has a clean title but in reality, it was involved in a total loss accident or was once historically declared as a total loss. Cars that have once been declared as salvaged can sometimes end up with clean titles through a process known as “title washing.”

Title Washing:

Here is how TITLE WASHING WORKS: Initially, the vehicle is branded as salvage in State A due to significant damage or previous issues. However, it can be sold to someone who then titles it in State B, a state that doesn’t apply a salvage branding during the registration process. Once the vehicle holds a clean title in State B, it may be sold (often discreetly) back to the original owner or another party in State A, effectively eliminating the salvage designation. There are also companies that specialize in facilitating this process, but it’s crucial to exercise extreme caution, as title washing is at best questionable and, in many cases, may be illegal. This practice highlights the importance of thoroughly researching a vehicle’s history and getting professional inspections to avoid potential pitfalls when purchasing a used car.

Here is a list of reasons why a total loss vehicle may be showing a clean title:

- Reporting Glitches: Glitches and errors can occur within report services and at the DMV. It’s not uncommon for vehicles with a total loss history to occasionally slip through the cracks and maintain a clean title. This can be attributed to inaccuracies in the reporting process.

- Incomplete Reporting: Sometimes, insurance companies or other entities involved fail to report a vehicle as a total loss to the DMV or relevant authorities. This oversight can result from various reasons, including clerical errors or miscommunication.

- Multiple Total Loss Criteria: Total loss determination criteria can vary, and some cases may not meet the threshold for a branded title. For instance, a vehicle may incur substantial damage that doesn’t reach the 75% threshold, leading to a total loss without a branded title.

- Limited Reporting: In certain instances, vehicles involved in accidents or thefts may not have their details reported to agencies like CARFAX or AutoCheck, which can lead to discrepancies in title branding.

- Rebuilt Titles: Another possibility is that the vehicle was previously branded as salvage but has since been repaired and rebranded with a clean title. Some states allow for the sale of vehicles with salvage titles that have been rebuilt to roadworthy condition.

- State Regulations: State-specific regulations and requirements play a significant role. In some states, vehicles with significant damage may be able to maintain a clean title if they meet certain criteria or undergo the necessary inspections and repairs.

- Disclosure: Sellers may not always disclose the full history of a vehicle, especially if they aim to maximize their profit. It is crucial for buyers to conduct thorough research and consider professional inspections before making a purchase.

It is imperative to acknowledge that the precise threshold for damage may vary across different companies. Nevertheless, it is important to note that not all vehicles that are deemed a total loss will automatically receive a DMV-reported branded title, such as a Salvage or Junk title.

The topic of discussion pertains to the consequences resulting from an accident. Specifically, the focus is on the damage incurred as a result of an accident. Multiple indicators may imply prior accidents or damage in the history of a vehicle. The aforementioned events encompass salvage auctions, instances of fire damage, police-reported accidents, crash test vehicles, damage disclosures, records from collision repair facilities, and records from automotive recyclers. When evaluating the historical background of a vehicle, it is crucial to take into account these pertinent factors.

What is a LEMON Buyback in CARFAX?

A Manufacturer Buyback, colloquially referred to as a Lemon, pertains to an automobile that has been repurchased by the manufacturer from its owner. This practice is commonly undertaken as a demonstration of benevolence or to rectify a particular flaw with the aim of guaranteeing customer contentment. Manufacturer buybacks often include the residual factory warranty and, in certain instances, an extended warranty that encompasses the rectified concern. In the event that an automobile has been repurchased by the manufacturer, it is possible for a Department of Motor Vehicles (DMV) or state agency to provide an official document or Manufacturer Buyback/Lemon title. It is noteworthy to acknowledge that the issuance of manufacturer buyback titles is not universal across all states, and the criteria for designating a vehicle as a lemon law vehicle can differ from one state to another.

Debunking Misconceptions Surrounding Manufacturer Buybacks:

It is commonly believed that all buybacks are inherently flawed: It is a well-established fact that buybacks are frequently undertaken with the primary objective of preserving a favorable customer relationship, rather than being solely driven by the presence of a defect.

The acquisition of a buyback entails assuming the pre-existing issues of the previous owner. It is a legal requirement for the manufacturer to assume full responsibility for addressing and rectifying any concerns prior to reselling a buyback vehicle. Every Manufacturer’s Buyback vehicle undergoes a comprehensive inspection to verify the successful resolution of the initial issue and to ascertain that the vehicle is in exceptional condition before it is resold.

Is it hard to sell a lemon or car with a rebuilt title: It is a well-established fact that the valuation of a vehicle is contingent upon its legal title. The inclusion of a lemon law provision in a title can potentially lead to a reduced purchase price for the buyer, and it may also confer a benefit to the buyer in subsequent negotiations for resale or trade-in.

Potential red flags with Total Loss vehicles:

- AIRBAG DEPLOYMENT: The utilization of a driver, passenger, or side airbag is indicated when a crash or other incident takes place and the airbag is deployed. In instances of this nature, it is imperative to engage the services of a certified technician to undertake the replacement of the deployed airbag.

- MANUFACTURER’S WARRANTY: Manufacturer’s basic warranties are commonly provided with new vehicles, and the duration and mileage coverage of these warranties can vary across different manufacturers.

- STRUCTURAL DAMAGE: Structural damage to a vehicle, such as damage to the frame or unibody, can occur as a consequence of an accident, regardless of its severity. This suggests that the vehicle has been previously engaged in a collision and has incurred damage at a certain juncture. It is imperative to acknowledge that there exists no distinction between a minor dent and a major accident when evaluating structural damage. The advent of unibody vehicles has resulted in the classification of both minor and major damage as structural damage, including small dents ranging from 1/8 inch to 1 inch in the body or structure.

- ELECTRICAL PROBLEMS: A total loss vehicle is more likely to face electrical problems. A car’s computer system is commonly referred to as the Engine Control Module (ECM) or Engine Control Unit (ECU). The cost to replace electrical wiring or the original computer can cost tens of thousands of dollars.

- Odometer readings: When a car has been rebuilt after a total loss it is more likely to have manipulated the odometer during the rebuild process. Rollbacks refer to the deliberate manipulation of an odometer with the intention of concealing the true mileage of a vehicle, often associated with fraudulent or unlawful practices. Rollbacks refer to situations in which the odometer resets to zero after it has reached its maximum reading. This occurrence can be attributed to mechanical or equipment limitations. Inconsistencies in mileage data pose a challenge for CARFAX in determining the possibility of a rollback, as they may arise from conflicting information or potential human error.

Correlating Total Loss Value to Insurance Payout

Insurance companies will typically rely on market value guides and other tools to assess the worth of the car. However, it’s important to note that the insurance payout may not cover the full cost of purchasing a similar car. Additionally, the car’s title is often marked with title brands, such as “salvage” or “rebuilt,” indicating that it has been through a total loss situation. The value of a total loss vehicle is determined by a variety of factors, including the pre-accident condition, mileage, age, and market demand. Insurance companies take into account these factors when calculating the insurance payout for a total loss vehicle. It’s important to note that the insurance payout may not cover the entire cost of purchasing a similar car, especially if the vehicle is older or has a high mileage. Additionally, the car’s title brands, such as “salvage,” can further impact its value. Buyers should be aware of these title brands in car titles, as they can affect the car’s resale value and insurance coverage in the future. By understanding the correlation between total loss value and insurance payout, car owners can better navigate the process after their car has been deemed a total loss by CARFAX.

Deciphering Title Brands in Car Titles

When purchasing a used car, it is crucial to understand the title brands that may be associated with it, especially if it is a Carfax Total Loss vehicle. Title brands indicate the history of the car, including any significant damages or issues it may have had in the past. Some common title brands include “salvage,” “flood,” or “rebuilt.” These brands inform potential buyers about the car’s condition and allow them to make an informed decision. By deciphering title brands in car titles, buyers can gain insight into the car’s history and assess whether it is a suitable option for them. By knowing that a car has been declared a total loss, buyers can assess the car’s condition, evaluate the repairs that have been made, and decide whether they are comfortable purchasing a car with this history.

Understanding the Role of Insurance Company in Total Loss Cases

The insurance company will conduct a thorough inspection and assessment of the car’s condition, considering various factors such as age, mileage, pre-accident condition, and market value. Additionally, state regulations may also affect the insurance company’s decision on whether to declare a vehicle as a Total Loss. The insurance company’s involvement in a Total Loss vehicle goes beyond just determining the payout amount. They also handle the necessary paperwork and title transfer process. This includes obtaining the salvage title for the Total Loss vehicle and updating the title brands to reflect the car’s loss history.

State-specific Guidelines and Title Rules for Total Loss Vehicles

Understanding the state-specific guidelines and title rules for total loss vehicles is crucial when dealing with a carfax total loss situation. Each state has its own set of regulations that dictate how a car’s title is branded when it has been totaled by the insurance company. These rules vary from state to state, and it is important to familiarize yourself with the specific requirements in your state. The title brand reflects the car’s history and helps potential buyers assess the condition of a total loss vehicle. By understanding these rules, you can navigate the process more efficiently and ensure that the car’s title accurately reflects its status as a carfax total loss vehicle.

Tips on Maximizing Insurance Claim Payouts

When it comes to maximizing your insurance claim payout for a Carfax Total Loss vehicle, there are a few key tips to keep in mind. First, it’s important to thoroughly document the condition of your car before the accident or incident that led to the total loss. Take detailed photos of the vehicle’s exterior, interior, and any additional features or upgrades that could impact its value. Additionally, make sure to gather all necessary paperwork, including maintenance records and receipts for any repairs or improvements made to the car. By providing comprehensive evidence of your car’s pre-loss value, you can increase your chances of receiving a higher payout from your insurance company.

Photo by RF._.studio on pexels

Photo by RF._.studio on pexels

Conclusion

In conclusion, understanding the implications of a ‘Carfax Total Loss’ declaration is crucial for anyone involved in the purchase, sale, or ownership of a vehicle. It’s essential to recognize that what might appear as minor damages could signal underlying issues requiring attention from a qualified mechanic or auto technician. Vehicles with a history of auto accident damage, whether it involves frame damage, cosmetic damage, or more extensive destruction, can significantly impact their market value and the feasibility of future repairs. For those considering salvage vehicles or those with a damage report, it’s imperative to assess the cost of vehicle repair against the vehicle’s value and consider options like gap insurance.

Collision coverage and settlements by insurance companies play a vital role in handling damage claims, especially in cases involving an at fault driver. Understanding damage disclosure requirements for motor vehicles, including registrable and consigned vehicles, is vital for a transparent vehicle purchase process. Additionally, the construction of unibody vehicles and the impact of damage from hail or other sources require thorough evaluation.

A damage appraisal should consider the extensive vehicle history database available, including records of past damage claims and repairs. For those looking at replacement vehicles, examining the history of any frame damage or signs of a crash test vehicle is essential. This due diligence helps in making an informed decision, ensuring the vehicle – forged with safety and reliability in mind – meets your needs.

Finally, keep in mind the factory warranty status and the importance of license plate information in the context of motor vehicles. Whether dealing with thousands of cars or just one, a comprehensive understanding of a vehicle’s history, including any potential total loss, damage appraisal, and insurance company market value settlement, is indispensable for a sound and secure vehicle purchase.